|

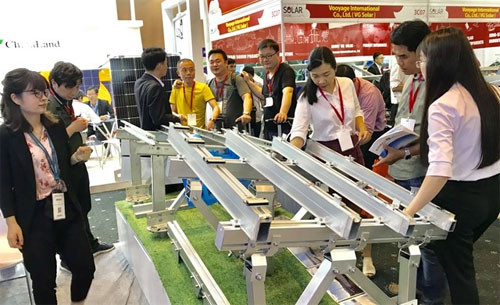

| Visitors visit a booth on Solar Show 2019 in HCM City. (Photo: VNA) |

Speaking on the sidelines of the conference, Nguyen Tam Tien, CEO of Trung Nam

Group, said that renewable energy generation has already significantly

increased. “Renewable energy, especially solar and wind power, will be the

future of Vietnam's long-term energy strategy,” he said.

Mai Van Trung, business development director at SolarBK, said the country has

favourable conditions to develop solar energy and that commercial and industrial

solar PV rooftop applications have great development potential.

Rooftop solar panels have also become more affordable for homeowners and

communities, he said.

Samresh Kumar, managing director of Principal Investment at VinaCapital, said

solar rooftop power presents an effective solution which provides a commercially

viable option, especially for the commercial and industrial segments.

Solar power leverages existing infrastructure and monetises idle assets without

requiring additional land, and it is also efficient because power is produced

only where it is needed and thus frees up the grid, he noted.

John Rockhold, head of the Power and Energy Sub-working Group under the Vietnam

Business Forum, said rooftop solar panels must be encouraged to reduce pressure

on the national grid, while modest annual price increases and a road map for

efficiency energy are badly needed.

Huge investment

Vietnam has a great opportunity to reach its energy security goals by attracting

local and foreign investment, according to Rockhold.

New technologies are creating opportunity for the renewable energy sector, he

said, adding that such technologies could help lower the cost of equipment for

solar and wind energy.

Vietnam will require around 10 billion USD annually between now and 2030 to meet

the growing demand of the energy sector, experts said.

With such high capital requirements, the government has allowed 100 percent

foreign ownership of Vietnamese companies in the energy sector.

Foreign investors can choose among permitted investment forms such as 100

percent foreign-invested company, joint ventures or public-private partnership

(PPP).

FDI and domestic investment from the private sector could include investment in

batteries and other storage methods, which would help stabilise supply and

extend the availability of solar and wind power sources.

By storing renewable energy and keeping supply high, prices for solar and wind

power could be lowered.

With low feed-in-tariffs (FiT) and high production costs, PPPs are the most

effective means of entering the market to minimise risks. The PPP term is

usually 20 years from the commercial operation date.

Government efforts

With 66 percent of rural inhabitants, Vietnam is scaling up its efforts to bring

electricity to the entire population, whether on or off-grid, increasing

electrification rates and preparing the country for growth.

Vietnam is one of the most efficient power markets in Southeast Asia, driven by

low-cost resources such as hydro and coal. The country has achieved around 99

percent electrification with relatively low cost in comparison to neighbouring

countries.

With electricity demand projected to increase by eight per cent annually until

2025, Vietnam aims to develop renewable energy sources to ensure energy security

and address growing power demand.

Hydropower currently holds the largest share among all renewable energy sources,

followed by biomass and wind. Solar energy, biogas, and waste-to-energy

technologies are picking up slowly while geothermal energy and tidal energy are

at a very early stage.

Renewables could become Vietnam’s lowest-cost option to meet its energy needs.

In recent years the Government has developed initiatives to boost renewable

energy, especially solar and wind power. Tax incentives include preferential

corporate income tax rate of 10 percent for 15 years, corporate income tax

exemption for four years, and a reduction of 50 percent for the following nine

years.

Other incentives include preferential credit loans, land use tax exemption, and

land rental exemption.

To ensure consistent returns for investors, the government has also approved

electricity prices for on-grid renewable energy, including standardised power

purchase contracts (20 years) for each renewable power type.

EVN, the sole buyer of electricity in Vietnam, has also been mandated to

prioritise renewable energy in grid connection, dispatch, and purchasing

electricity at approved tariffs.

From now until 2030, Vietnam’s economy is forecast to grow at a high rate of

between 6.5 and 7.5 percent per year.

The conference was held during the two-day Solar Show Vietnam 2019, Power &

Electricity Show Vietnam, Energy Storage Show Vietnam, and Wind Show Vietnam,

which attracted hundreds of policymakers, regulators, investors and financiers

from Vietnam, Asia-Pacific region and beyond.

The trade shows were also attended by power producers, project developers,

renewable energy vendors, and business owners and land developers.-VNS/VNA

.jpg)

.jpeg)

.jpeg)

.jpeg)