|

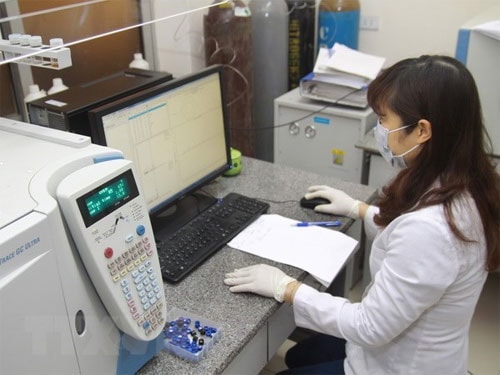

The Government has issued a decree creating more favourable conditions

for the development of businesses operating in the field of science

and technology (Photo: VNA)

Under the decree, which takes effect from March 20, these businesses will enjoy

preferential treatment such as corporate tax cuts and exemptions, cuts in land

and water surface lease fees and credit incentives, the Government news portal

baochinhphu.vn reported on February 13.

Scientific and technological businesses with income sourced from creating and

selling products which result from scientific research and technological

development will get corporate tax reduction and exemption the same as

businesses with new investment projects in scientific research and technological

development. Specifically, they will be exempted from corporate tax for four

years and get a reduction of 50 percent in the nine following years.

The decree also stipulates that scientific and technological businesses will be

exempt from or get a cut in land and water surface lease fees.

Concerning credit incentives, the decree states that projects investing in

products which result from businesses’ scientific research and technology

development will be provided with State’s investment credit.

Science and technology businesses that carry out scientific and technological

tasks and apply science and technology in production and trade will get

financial support or credit with preferential interest rates from the national

fund for technological renewal and from the fund for scientific and

technological development of the Ministry of Science and Technology and of

relevant ministries, agencies and localities.

Businesses with feasible scientific and technological development projects will

get loans with preferential interest rates from the national fund for

technological renewal and from the fund for scientific and technological

development of the Ministry of Science and Technology and of relevant

ministries, agencies and localities or will be guaranteed to get loans from

commercial banks.

Under the decree, scientific and technological businesses will also get import

and export tax incentives for research and development.

These businesses will also get priority in using equipment at key national

laboratories, State-owned scientific research and technology facilities and

technology incubators.

Source: VNA

.jpg)

.jpeg)

.jpeg)

.jpeg)